SPRING 2020, THE EVIDENCE FORUM, WHITE PAPER

Valeria Burrone, PhD Senior Project Manager Peri- and Post-Approval Interventional Studies Evidera |  Lorna Graham, MSc Director Project Management Peri- and Post-Approval Interventional Studies Evidera |  Andrew Bevan, MRes, MRSB, CBiol Senior Director Project Management Peri- and Post-Approval Studies Evidera |

Introduction

Digital therapeutics (DTx) are a digital health category defined by the Digital Therapeutics Alliance as products that “deliver evidence-based therapeutic interventions to patients that are driven by high quality software programs to prevent, manage, or treat a medical disorder or disease.”1 DTx are distinct from digital medicines or “smart pills,” which combine a prescription medication with an ingestible sensor that is designed to communicate with a software application to track compliance.

Advances in and the increasingly dominant role of mobile technology and artificial intelligence (AI) in our everyday lives have broadened the role of DTx in healthcare. Although, historically, interest in developing DTx was mainly confined to academia and technology companies, the potential to use DTx in conjunction with medicines to improve health outcomes has sparked the interest of big pharma, who have started to venture into the DTx space through investments and strategic partnerships with tech companies.2 This exciting advancement will create opportunities to increase patients’ awareness of their health and their ability to play a more active role in managing their disease, thereby creating the potential to improve health outcomes and reduce the demands on healthcare systems compared to traditional pharmacological interventions alone.3,4 The DTx market is expected to grow tenfold in the next three to five years, with a projected market value of $9 billion (USD) by 2025.5 However, this presents challenges in terms of how the technology is regulated, how healthcare providers (HCP) respond to this paradigm shift, and how these technologies are reimbursed.

In this article, we will review the trends in the development of DTx over the past decade, the current landscape, future prospects, and some of the challenges faced by companies looking to commercialize DTx applications.

Trends over the Past Decade

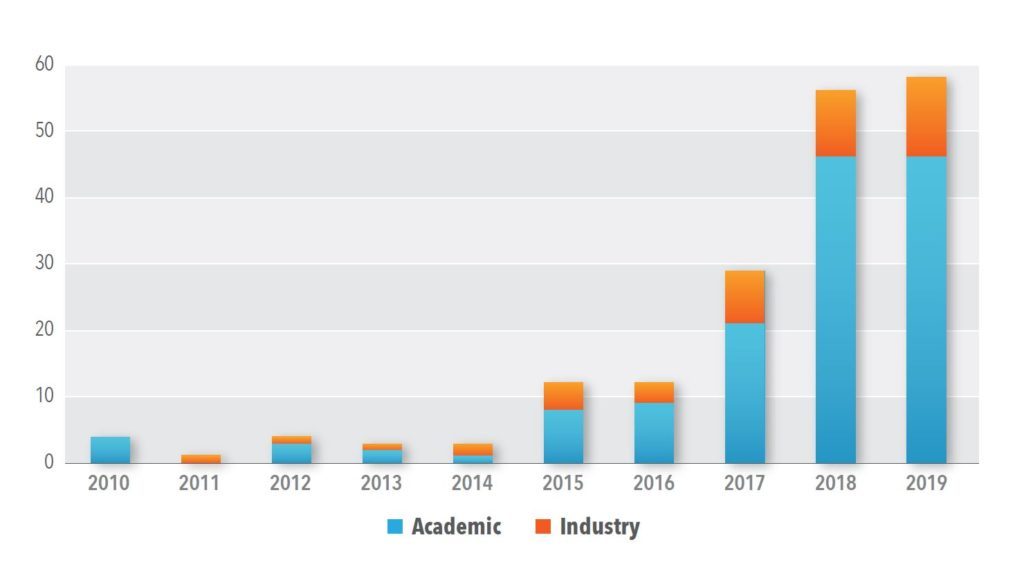

Study titles containing the word “digital” that were registered between January 2010 and December 2019 were searched on clinicaltrials.gov. Of the resulting 557 studies, 182 were determined to be interventional trials of DTx applications based on protocol title and type of intervention. Out of those 182 studies, 167 trials (92%) were registered with clinicaltrials.gov in the past five years, during the time when the number of DTx application trials increased more than five times from 12 in 2015 to 58 in 2019 (See Figure 1).

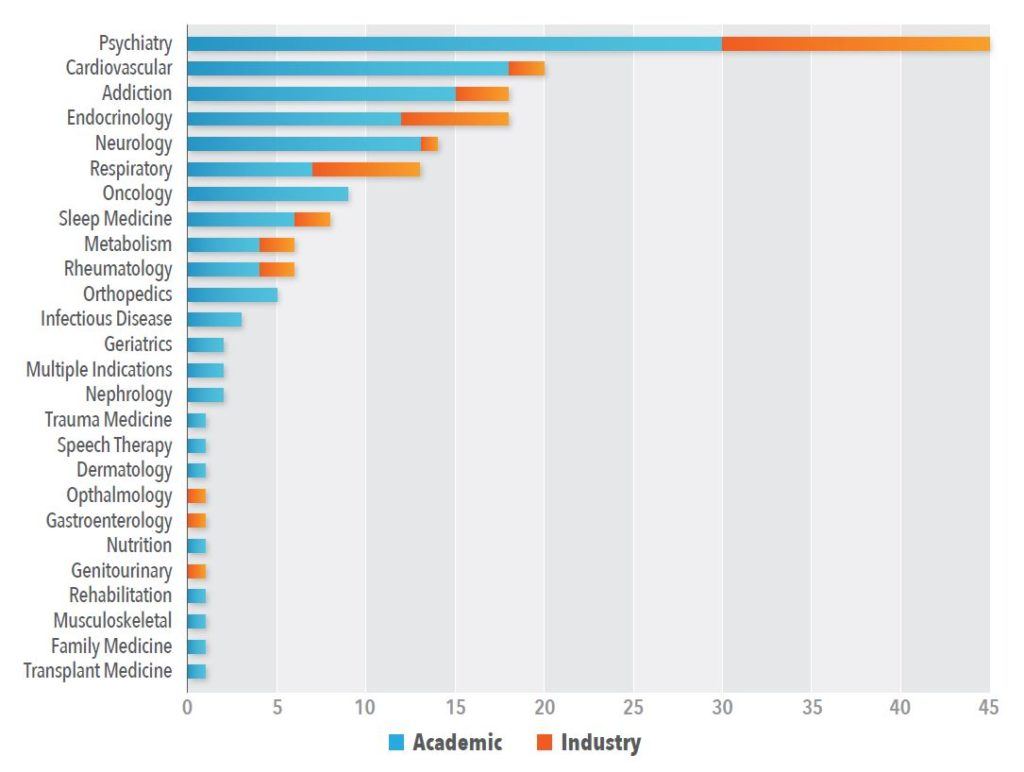

With respect to therapeutic areas (TA) under investigation, the highest percentage of trials have been conducted in psychiatric indications (25%) – and there is strong evidence supporting digital cognitive behaviour therapy’s (DCBT) efficacy in this area6 – followed by cardiovascular (11%), endocrine (10%), addiction (10%), neurology (8%), and respiratory (7%) (See Figure 2). Seventy-seven percent of DTx trials conducted over the past 10 years have been sponsored by academia, which has dominated research across all TAs apart from respiratory, where 50% of trials have been sponsored by industry. Although traditional cognitive behaviour therapy (CBT) has been effective in improving health outcomes in chronic nephrology7 and gastroenterology8 indications, there has been very little research to investigate the effectiveness of digital modalities in these TAs.7,8

Future Prospects for DTx

A pipeline review of nine leading DTx companies (See Figure 3) revealed the development of therapeutic applications for a diverse range of neuroscience indications, such as attention deficit hyperactivity disorder (ADHD), autism spectrum disorder (ASD), schizophrenia, depression, and bipolar disorder, dominates commercial research and development (R&D), which follows the trend seen in the analysis conducted for the clinicaltrials.gov trials. Furthermore, a focus on the development of solutions for cardiovascular disease (CVD) such as hypertension, hyperlipidemia, and acute coronary syndrome (ACS) is consistent with trends seen in clinical trials over the past decade. However, the focus on developing DTx solutions for gastrointestinal diseases, such as irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), and gastroesophageal reflux disease (GERD), bucks the trend seen over the past decade. This suggests that DTx companies are looking to diversify their pipelines by adding new indications were there is currently unmet need, including chronic kidney disease (CKD),9 and where the potential for DTx to improve health outcomes has been highlighted.10 Pediatrics is another area with a high degree of unmet medical need, to the extent that in 2003, the Pediatric Research Equity Act (PREA)11 was introduced in the United States (US) specifically to address the lack of approved pharmaceutical treatment options available for children. Furthermore, in the United Kingdom (UK), there have been challenges ensuring mental health provision for children and young adults due to difficulties engaging this population and issues with lack of funding12 and treatments. However, DTx represents a unique opportunity to engage this population with the aim of improving health outcomes since UK statistics indicate that more than 95% of individuals aged 16 to 34 own a smartphone13 and many also own tablet computers and/or game consoles.

A pipeline review of nine leading DTx companies (See Figure 3) revealed the development of therapeutic applications for a diverse range of neuroscience indications, such as attention deficit hyperactivity disorder (ADHD), autism spectrum disorder (ASD), schizophrenia, depression, and bipolar disorder, dominates commercial research and development (R&D), which follows the trend seen in the analysis conducted for the clinicaltrials.gov trials. Furthermore, a focus on the development of solutions for cardiovascular disease (CVD) such as hypertension, hyperlipidemia, and acute coronary syndrome (ACS) is consistent with trends seen in clinical trials over the past decade. However, the focus on developing DTx solutions for gastrointestinal diseases, such as irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), and gastroesophageal reflux disease (GERD), bucks the trend seen over the past decade. This suggests that DTx companies are looking to diversify their pipelines by adding new indications were there is currently unmet need, including chronic kidney disease (CKD),9 and where the potential for DTx to improve health outcomes has been highlighted.10 Pediatrics is another area with a high degree of unmet medical need, to the extent that in 2003, the Pediatric Research Equity Act (PREA)11 was introduced in the United States (US) specifically to address the lack of approved pharmaceutical treatment options available for children. Furthermore, in the United Kingdom (UK), there have been challenges ensuring mental health provision for children and young adults due to difficulties engaging this population and issues with lack of funding12 and treatments. However, DTx represents a unique opportunity to engage this population with the aim of improving health outcomes since UK statistics indicate that more than 95% of individuals aged 16 to 34 own a smartphone13 and many also own tablet computers and/or game consoles.

The 21st Century Cures Act14 (Cures Act), which became law in the US on December 13, 2016, is paving the way for tech companies to streamline the development of new technology that improves the treatment of serious diseases that have unmet medical needs. The law includes several important regulatory changes designed to facilitate advances in DTx. One such change is the introduction of the FDA Breakthrough Devices Program15 that offers manufacturers an opportunity to interact with the experts at the Food and Drug Administration (FDA) and efficiently address topics as they arise during the premarket review phase to make timely and agreed upon adjustments based on FDA’s feedback. An additional benefit is that manufacturers also receive prioritized review of their submission. The goal of the program is to provide patients and healthcare providers with quicker access to medical devices, and since its introduction, several manufacturers have been given breakthrough designation for their leading DTx products.16-18

There exists a dichotomy between the “move fast and break things” philosophy of the tech industry and the need for robust evidence-based health solutions. However, the DTx industry has established core principles and best practices (See Box 1) to ensure that tech companies provide evidence to support claims of safety, efficacy, equality of performance, and quality of their DTx products. Although these are not currently stringent regarding the burden of evidence required for a medical product or device, regulatory authorities are implementing frameworks in order to rigorously assess DTx.

Creating Formularies for DTx

The increasing DTx options present patients and providers with a challenge for selecting the relevant application for a given disease.

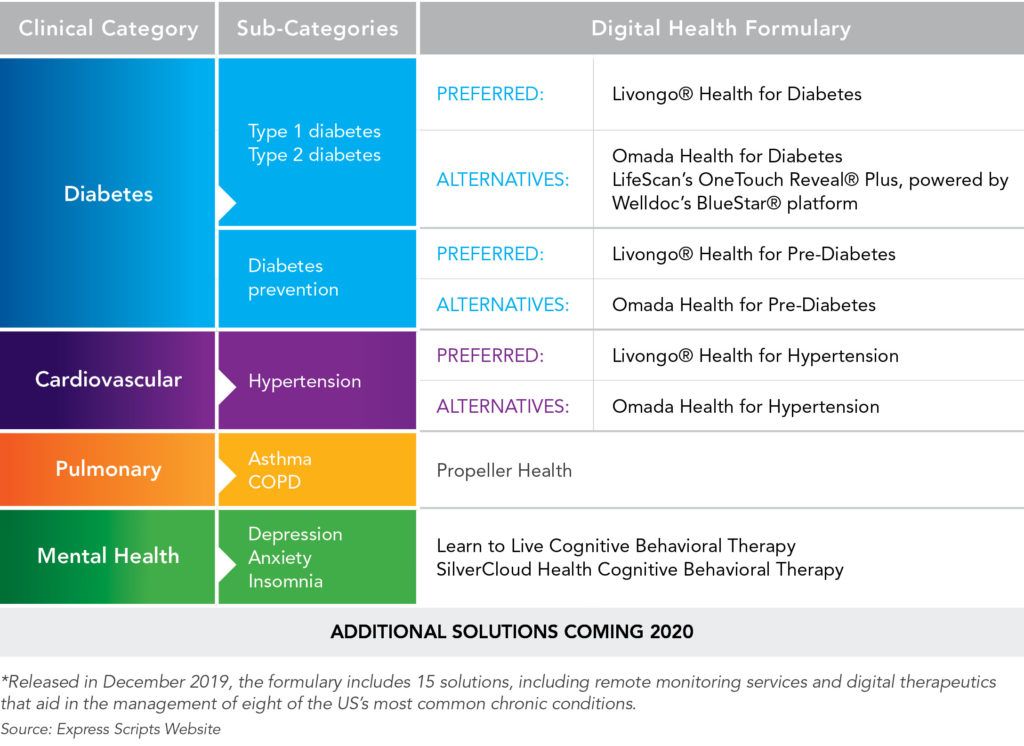

In May 2019, Express Scripts started developing the first Digital Health Formulary to support HCPs in identifying treatments with the greatest overall value for patients. The first release of the Digital Health Formulary included 15 applications that aid in the management of the country’s eight most common chronic conditions: diabetes, prediabetes, hypertension, asthma, pulmonary disease, depression, anxiety, and insomnia (See Table 1). The formulary will be reviewed and additional solutions will be added in 2020.20

In addition to the Express Scripts initiative, National Health Service (NHS) England is working with the National Institute for Health and Care Excellence (NICE) to support a new digitally enabled therapy assessment program to expand the provision of psychological therapies under the NHS’s Improving Access to Psychological Therapies (IAPT) and Improving Access to Digital services as set out in the Five Year Forward View for Mental Health and the NHS Long Term Plan.21 NHS England is managing all stages of this project, including selection and assessment of technologies, supporting development of technologies, and testing them in practice. NICE is responsible for the technology supplier selection and assessment, the IAPT assessment briefing report, and the production of the final evaluation for each digital therapy product. To date, NICE has provided IAPT assessment briefing reports for 14 digital therapy products, which will be assessed for use in NHS.22

Table 1. The First Cohort of Solutions in the Express Scripts Digital Health Formulary*

Regulatory Challenges

The regulatory landscape for DTx is still evolving, and while the ultimate goal of regulation is to ensure that DTx applications are safe and effective, the FDA’s Center for Devices and Radiological Health (CDRH) has acknowledged, through its Digital Health Innovation Action Plan,23 that the “FDA’s traditional approach to moderate and higher risk hardware-based medical devices is not well suited for the faster iterative design, development, and type of validation used for software-based medical technologies.” The plan, which follows the imperatives established by the Cures Act, describes the FDA’s steps to reimagine their policies, processes and tools to align with the needs of emerging technologies, and highlights three focus areas for the FDA:

- New FDA guidelines on the regulation of digital therapeutics, especially with respect to multi-functionality (i.e., products with some software functions that fall under the FDA medical device oversight and others that do not), software changes to an existing device, and the clinical approach to Software as a Medical Device (SaMD).

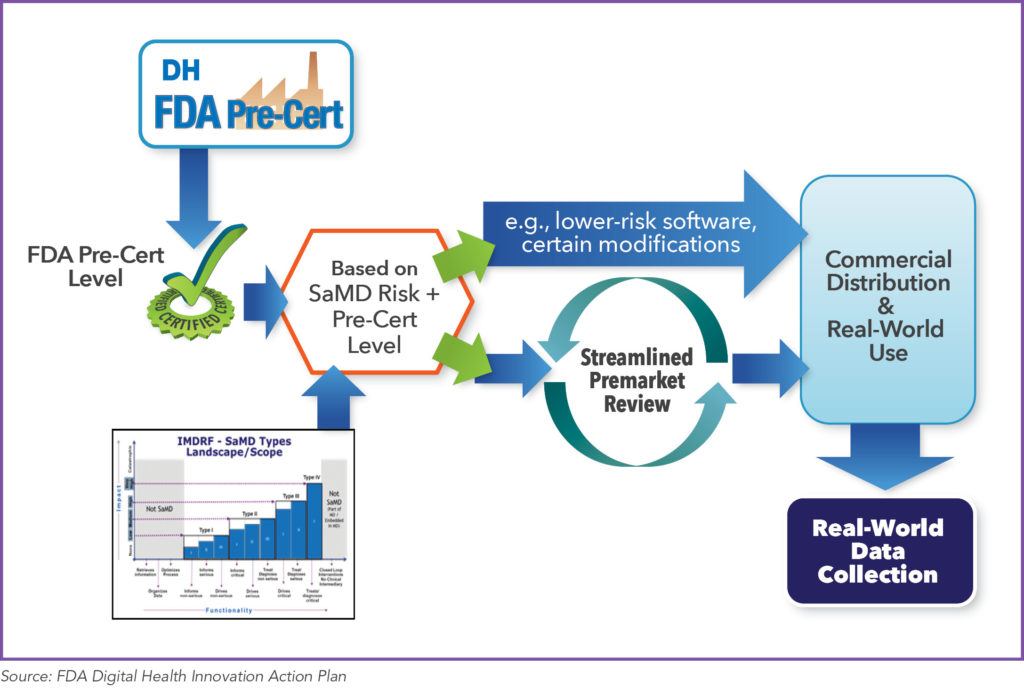

- The development of a Software Precertification Program (Pre-Cert) aimed to replace the need for a premarket submission for certain products and allow for reduced submission content and/or faster review of the marketing submission.

- An increase of digital health expertise in the CDRH by hiring new staff who have a deep understanding and experience with software development and its application to medical devices or chemical and biological entities to improve the quality, predictability, consistency, timeliness, and efficiency of decision making for individual products and developers.

In 2019, the FDA began a test phase of the program with a limited number of organizations, applying both the Pre-Cert model and the traditional review process to each premarket submission, with the intent to confirm that the framework provides a reliable equivalence in terms of assuring safety and effectiveness for SaMD as the mainstream review pathway. This retrospective testing achieved its objective in identifying the feasibility of the streamlined review package and excellence appraisal summary as sufficient to conduct a premarket review of SaMD. Next steps will be to confirm these early results with prospective testing outcomes.24

The FDA’s vision for the future is that companies taking advantage of the Pre-Cert program will also be able to utilize the National Evaluation System for health Technology (NEST) system.25 This aims to generate better evidence for medical device evaluation and regulatory decision making across the device lifecycle by collecting post-market, real-world data in order to affirm the regulatory status of the product and support new applications of the technology (See Figure 4). This aligns with the FDA’s wider effort to establish guidelines to incorporate real-world evidence (RWE) in the regulatory decision-making process.26

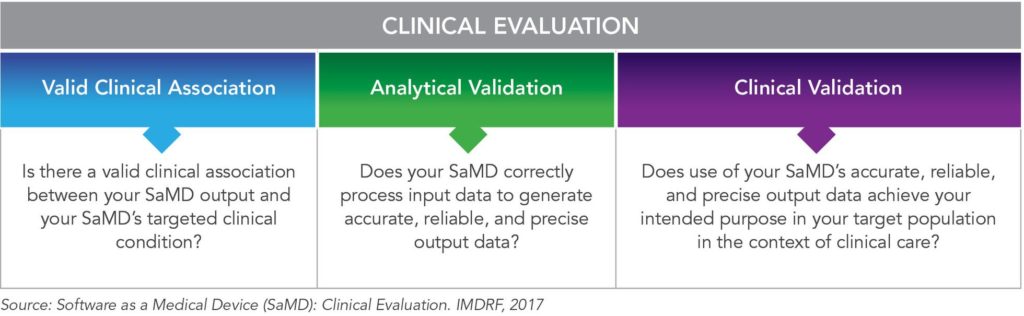

The FDA is also part of an international effort to accelerate the harmonization of medical device regulations, including SaMD, through the International Medical Device Regulatory Forum (IMDRF), which includes medical device regulators from Australia, Brazil, Canada, China, European Union (EU), Japan, Russia, and Singapore. In 2017, the IMDRF SaMD Working Group published a technical document for planning the clinical evaluation process of an SaMD27 for a harmonized global approach (See Figure 5).

Figure 5. Clinical Evaluation Process for SaMD

Reimbursement and Market Uptake

In addition to the regulatory challenges, the DTx industry also faces pricing and reimbursement challenges as the traditional pricing and payer reimbursement models, where providers are paid based on the amount of service they deliver, are not well suited for DTx. Until recently, direct-to-consumer (DTC) approaches, with users paying subscription fees to access DTx applications, has been the main channel for reimbursement in the industry. However, it is generally acknowledged that this is not a sustainable long-term market strategy, and therefore, DTx companies are exploring other channels to generate revenue, including the business-to-business-to-consumer (B2B2C) approach of selling products through online retail outlets.28 In theory, a value-based healthcare delivery model where providers are paid based on patient health outcomes would appear to be a viable path for reimbursement, but this is dependent on robust RWE being available to support claims and demonstrate value. This emphasizes the importance of digital health formularies, such as what Express Scripts has developed, to increase the awareness of and confidence in evidence-based DTx solutions among HCPs and payers alike to help drive market uptake. Ultimately, payers need evidence of the clinical and economic benefits of DTx for these products to receive market access and be successful in the marketplace. A recent study conducted by McKinsey in partnership with the German Managed Care Association (BMC) estimated that up to €4.3 billion in potential healthcare savings could have been realized in 2018 if the German healthcare system had adopted all of the available digital solutions for patient self-treatment and patient self-care.29,30 This demonstrates DTx’s potential to reduce healthcare costs.

Conclusion

The rapid growth in research into DTx over the past decade has resulted in the commercialization of evidence-based applications that are set to become major disrupters to healthcare markets over the next decade. As DTx’s reach in terms of therapeutic use and market penetration increases, so does its potential to positively impact public health and reduce healthcare costs. This will force a paradigm shift among regulators, payers, and providers to revaluate their approaches to ensure that they are fit for purpose. While progress is being made in the area of regulation and health technology assessment, progress with reimbursement pathways is lagging partially due to the need for RWE generation for DTx applications to demonstrate value. As a result, tech companies are looking to other channels such as the B2B2C selling model in order to increase market penetration and generate more sustainable revenue streams.

References

- Digital Therapeutics Alliance. Available at: https://dtxalliance.org/. Accessed March 2, 2020.

- Hendrickson Z. Big Pharma is Breaking into the $3 Billion Digital Therapeutics Market. Business Insider. Sep 19, 2019. Available at: https://www.businessinsider.com/pharma-edging-into-digital-therapeutics-2019-9. Accessed March 2, 2020.

- Park S, Garcia-Palacios J, Cohen A, Varga Z. From Treatment to Prevention: The Evolution of Digital Healthcare. NatureResearch. Available at: https://www.nature.com/articles/d42473-019-00274-6. Accessed March 2, 2020.

- Chung JY. Digital Therapeutics and Clinical Pharmacology. Transl Clin Pharmacol. 2019 Mar;27(1):6-11. doi: 10.12793/tcp.2019.27.1.6. Epub 2019 Mar 27.

- LaRock Z. Digital Therapeutics Explained: DTx Market Trends and Top Companies Delivering on the Latest Digital Health Opportunity. Business Insider. Dec 18, 2019. Available at: https://www.businessinsider.com/digital-therapeutics-report. Accessed: March 2, 2020.

- Lattie EG, Adkins EC, Winquist N, Stiles-Shields C, Wafford QE, Graham AK. Digital Mental Health Interventions for Depression, Anxiety, and Enhancement of Psychological Well-Being Among College Students: Systematic Review. J Med Internet Res. 2019 Jul 22;21(7):e12869. doi: 10.2196/12869.

- Ng CZ, Tang SC, Chan M, et al. A Systematic Review and Meta-Analysis of Randomized Controlled Trials of Cognitive Behavioral Therapy for Hemodialysis Patients with Depression. J Psychosom Res. 2019 Nov;126:109834. doi: 10.1016/j.jpsychores.2019.109834. Epub 2019 Sep 10.

- Feingold J, Murray HB, Keefer L. Recent Advances in Cognitive Behavioral Therapy for Digestive Disorders and the Role of Applied Positive Psychology Across the Spectrum of GI Care. J Clin Gastroenterol. 2019 Aug;53(7):477-485. doi: 10.1097/MCG.0000000000001234.

- Better. Clinical Development Pipeline. Available at: https://www.bettertherapeutics.io/pipeline/. Accessed March 2, 2020.

- Diamantidis CJ, Becker S. Health Information Technology (IT) to Improve the Care of Patients with Chronic Kidney Disease (CKD). BMC Nephrol. 2014 Jan 9;15:7. doi: 10.1186/1471-2369-15-7.

- Public Law 109-155-Dec 3, 2003. Pediatric Research Equity Act of 2003. Available at: https://www.congress.gov/108/plaws/publ155/PLAW-108publ155.pdf. Accessed March 2, 2020.

- Taraman S. Digital Therapeutics Can Solve the Greatest Unmet Need in Behavioral Healthcare: Early Intervention. MedCityNews. Available at: https://medcitynews.com/2020/01/digital-therapeutics-can-solve-the-greatest-unmet-need-in-behavioral-healthcare-early-intervention. Accessed March 2, 2020.

- Statista. Do You Personally Use a Smartphone?* – By Age. Available at: https://www.statista.com/statistics/300402/smartphone-usage-in-the-uk-by-age/. Accessed March 2, 2020.

- The 21st Century Cures Act. H.R. 34, 114 Congress. 2016. Available at: https://www.congress.gov/114/plaws/publ255/PLAW-114publ255.pdf. Accessed March 2, 2020.

- U.S. Food and Drug Administration. Breakthrough Devices Program. Available at: https://www.fda.gov/medical-devices/how-study-and-market-your-device/breakthrough-devices-program. Accessed March 2, 2020.

- Pear Therapeutics. Press release. Pear Therapeutics Receives Expedited Access Pathway Designation from FDA for Reset-OTM Prescription Digital Therapeutic to Treat Opioid Use Disorder. Available at: https://peartherapeutics.com/pear-therapeutics-receives-expedited-access-pathway-designation-fda-reset-o-prescription-digital-therapeutic-treat-opioid-use-disorder/. Accessed March 3, 2020.

- Intrado. Cognoa. Press release. Cognoa Receives FDA Breakthrough Designations for Autism Diagnostic and Digital Therapeutic Devices. Available at: http://www.globenewswire.com/news-release/2019/02/06/1711471/0/en/Cognoa-Receives-FDA-Breakthrough-Designations-for-Autism-Diagnostic-and-Digital-Therapeutic-Devices.html. Accessed March 3, 2020.

- Dthera Sciences. Dthera Sciences Receives FDA Breakthrough Device Designation for Its Alzheimer’s Focused Development-Stage Product “DTHR-ALZ”. Cision PR Newswirse. Aug 23, 2018. Available at: https://www.prnewswire.com/news-releases/dthera-sciences-receives-fda-breakthrough-device-designation-for-its-alzheimers-focused-development-stage-product-dthr-alz-300701487.html. Accessed March 10, 2020.

- Digital Therapeutics Alliance. Digital Therapeutics Definition and Core Principles. Available at: https://dtxalliance.org/wp-content/uploads/2019/11/DTA_DTx-Definition-and-Core-Principles.pdf. Accessed March 3, 2020.

- Express Scripts. Express Scripts Makes Digital Health Click. Available at: https://www.express-scripts.com/corporate/articles/digital-health-formulary-announced. Accessed March 3, 2020.

- NHS England. Digital Therapy Selection. Available at: https://www.england.nhs.uk/mental-health/adults/iapt/digital-therapy-selection/. Accessed March 4, 2020.

- National Institute for Health and Care Excellence (NICE). Digital Therapies Assessed and Accepted by the Improving Access to Psychological Therapies Programme (IAPT). Available at: https://www.nice.org.uk/about/what-we-do/our-programmes/nice-advice/improving-access-to-psychological-therapies–iapt-/submitting-a-product-to-iapt. Accessed March 4, 2020.

- U.S. Food and Drug Administration (FDA). Digital Health Innovation Action Plan. Available at: https://www.fda.gov/media/106331/download. Accessed March 4, 2020.

- U.S. Food and Drug Administration (FDA). Software Precertification Program 2019 Mid-Year Update. Available at: https://www.fda.gov/media/129047/download. Accessed March 4, 2020.

- U.S. Food and Drug Administration (FDA). National Evaluation System for health Technology (NEST). Available at: https://www.fda.gov/aboutfda/centersoffices/officeofmedicalproductsandtobacco/cdrh/cdrhreports/ucm301912.htm. Accessed March 4, 2020.

- U.S. Food and Drug Administration (FDA). Framework for FDA’s Real-World Evidence Program. Available at: https://www.fda.gov/media/120060/download. Accessed March 4, 2020.

- International Medical Device Regulators Forum (IMDRF). Final Document: Software as a Medical Device (SaMD): Clinical Evaluation. Available at: http://www.imdrf.org/docs/imdrf/final/technical/imdrf-tech-170921-samd-n41-clinical-evaluation_1.pdf. Accessed March 4, 2020.

- Business Insider. DarioHealth is Selling Its Products on Walmart.com as It Shifts Away from Direct-to-Consumer Sales. Available at: https://www.businessinsider.com/dariohealth-sells-products-on-walmartcom-2019-12?r=US&IR=T. Accessed March 4, 2020.

- McKinsey & Company. Exploring the Potential of Digital Therapeutics. Available at: https://www.mckinsey.com/industries/pharmaceuticals-and-medical-products/our-insights/exploring-the-potential-of-digital-therapeutics#. Accessed March 4, 2020.

- McKinsey & Company. Digitization Healthcare – Opportunities for Germany. Available at: https://www.mckinsey.de/~/media/mckinsey/locations/europe%20and%20middle%20east/deutschland/news/presse/2018/2018-09-25-digitalisierung%20im%20gesundheitswesen/digitizing%20healthcare__mckinsey%20neu.ashx. Accessed March 4, 2020.

For more information, please contact us.