SPRING 2019, THE EVIDENCE FORUM, WHITE PAPER

Karen Sandman, PhD Vice President and General Manager Market Access Communications Evidence Synthesis, Modeling & Communication Evidera |  Leigh Ann White, PhD Executive Director, Client Services Evidence Synthesis, Modeling & Communication Evidera |

This issue of The Evidence Forum includes discussions on a variety of methodologies that can be used to understand, characterize, and document unmet need and product value in rare diseases. One question that comes to mind is, “Do we need all this? If a disease is rare enough, and severe enough, doesn’t the unmet need speak for itself?” If only it were so easy! As anyone who has worked in rare diseases in the past decade can attest, the “glory days” of easy market access for orphan drugs – if they ever existed – are over.

Certainly, there are many healthcare systems, such as those in Germany and Australia, that evaluate treatments for orphan diseases differently than those for more common conditions. Most payers recognize that orphan drugs have high prices because the cost of developing the drug and keeping it on the market is not proportional to the size of the target population, and manufacturers need to price sufficiently high to maintain profitability and, therefore, be able to provide the drug to the patients who need it. Despite understanding the unique aspects of orphan diseases, payers are managing finite healthcare resources, and there has been a steady uptick in the number of orphan drugs on the market in recent years.

The balance between the desire to provide equitable treatment to patients with rare diseases and the need to contain healthcare spending can lead to unique challenges in demonstrating the value of orphan drugs. The core principles of market access apply, regardless of the disease: the manufacturer needs to make a clear case for burden of illness, unmet need, clinical efficacy and safety, comparative effectiveness, patient-relevant outcomes, and economic value. In the case of orphan drugs, however, evidence may be scant, or it may be necessary to provide additional context for the available evidence.

In general, teams who are preparing to launch drugs in orphan indications have strong awareness of the level of evidence needed to support their product’s value proposition, but for any number of reasons their evidence package often falls short in one or two key areas. The two main reasons tend to be that:

- The market access and HEOR teams are not involved early enough in the process – often because the product was acquired close to launch

- Those responsible for the pivotal trial design are unaware or skeptical of the need for payer-relevant endpoints, such as healthcare resource utilization and a validated, disease-specific measure of health-related quality of life

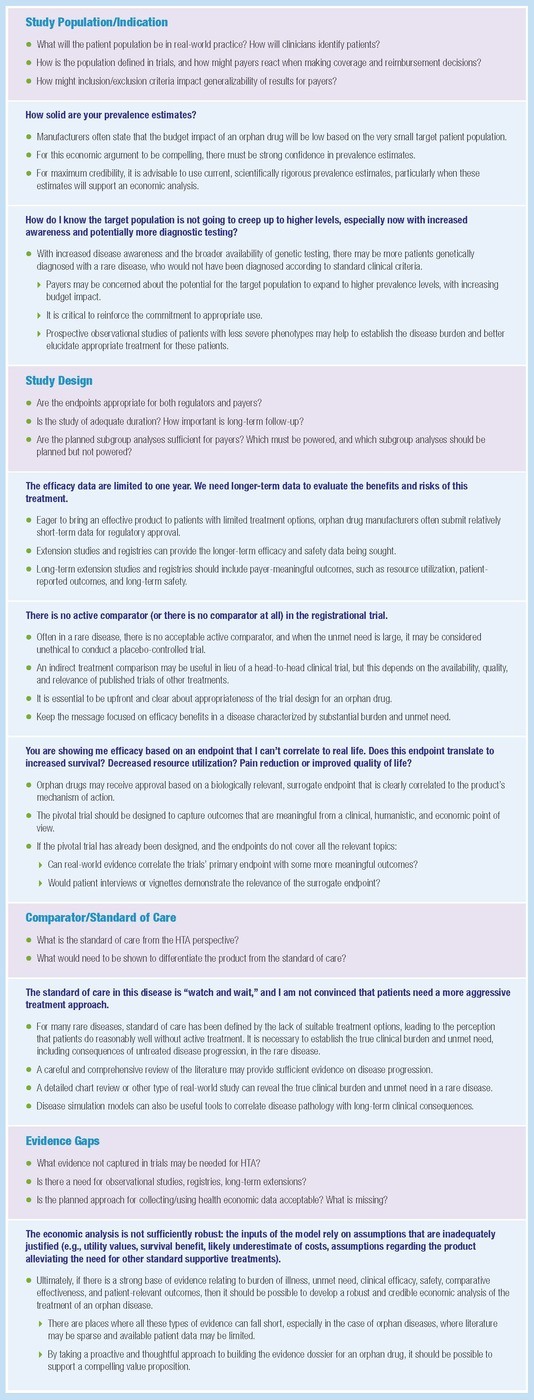

One way to preemptively address these issues is to seek Early Scientific Advice, in which manufacturers can consult with regulators and health technology assessment (HTA) bodies regarding the types of clinical and HEOR evidence that would be necessary and sufficient to support regulatory approval and market access (See Table 1). Unlike a purely regulatory consultation, Early Scientific Advice engages with market access experts to obtain input on the types of evidence that would be most supportive during the HTA process. Early Scientific Advice, which is non-binding, can come from a single HTA authority, such as the G-BA (the Federal Joint Committee) in Germany or NICE (National Institute for Health and Care Excellence) in the UK, or it may include multiple HTA bodies, in the context of EUnetHTA Multi-HTA Early Dialogues or EUnetHTA/European Medicines Agency (EMA) Parallel Consultation.

A manufacturer should plan ahead to engage in Early Scientific Advice as it may take about six months to prepare for the process, which should occur during Phase II. Ideally, there should be time for clinical development and market access teams to consider how to apply the advice to the Phase III trial design and to additional studies to address payer evidence gaps.

Instead of having to differentiate a product in a crowded primary care market, often with generic competition, manufacturers of orphan drugs are faced with the challenge of finding difficult-to-obtain evidence, which requires a good deal of planning and foresight. Ultimately, though, payers are looking for the same types of evidence regardless of how many patients are affected by the disease – does this product safely and effectively address an unmet medical need, and is its cost acceptable within the constraints on how we spend our healthcare funds? With Early Scientific Advice, the manufacturer has an opportunity to discuss with decision makers before finalizing the evidence generation plan, to ensure that the studies ask and answer the most relevant questions.

Table 1. Key Questions Addressed in Early Scientific Advice … and How They Relate to Orphan Drugs

For more information, please contact

[email protected] or [email protected]