FALL 2020, THE EVIDENCE FORUM, WHITE PAPER

Ariel Berger, MPH Executive Director, Integrated Solutions Real-World Evidence Evidera, a PPD business |  Sherry Wu, MPH Research Associate Evidence Synthesis, Modeling & Communication Evidera, a PPD business |  Robert Musci, MS Research Associate Evidence Synthesis, Modeling & Communication Evidera, a PPD business |  Sandra Milev, MSc Research Scientist and Director Evidence Synthesis, Modeling & Communication Evidera, a PPD business |  Sonja Sorensen, MPH Vice President, Modeling & Simulation Evidence Synthesis, Modeling & Communication Evidera, a PPD business |

Therapeutics must demonstrate efficacy and safety to relevant regulatory authorities before they are approved for use in clinical practice. This is a relatively straightforward process, assuming the treatment positively impacts the relevant therapeutic area (e.g., ability to prevent major adverse coronary events [MACE] in coronary heart disease, ability to maintain/improve lung function in respiratory disease). While necessary, efficacy and safety alone are insufficient for a successful launch, as decision makers who safeguard access to therapies must have evidence of the value-for-money associated with new therapies before they allow for widespread use.

Unlike regulatory hurdles of efficacy and safety, demonstrating value is more challenging. Why is this the case? One reason is “value” can mean different things to different stakeholders. For example, patients likely perceive value primarily in terms of effectiveness and safety (and potentially convenience). Conversely, payers may be more focused on economic implications, especially if less expensive and well-known alternatives exist. Physicians likely fall in the middle, wanting to provide optimal patient care while thinking about pricing/profit.

To maximize uptake, manufacturers must demonstrate value that resonates with each relevant stakeholder. However, it has been our experience that manufacturers tend to focus primarily on payers, risking optimal market access after regulatory approval because such evidence, while important, may not resonate with all relevant decision makers.

We will look at how value is perceived by different stakeholders, using case studies to illustrate differences. We will also provide suggestions to guide evidence generation efforts that incorporate multiple perspectives. Our recommendations are intended to help manufacturers generate evidence to inform discussions on value, both internally and externally, from early in the development process through loss of exclusivity.

Efficacy and Safety … and Value?

The road to regulatory approval for a new drug can be challenging. Only about one in nine drugs that reach clinical testing will ultimately receive regulatory approval; moreover, the process often takes between six to seven years.1 By the time clinical testing is complete, overall development cost before submission for regulatory approval may have already exceeded $1 billion.1 Many manufacturers dedicate substantial time and resources to generating evidence of efficacy and safety during the early phases of development. Companies often wait until the peri-approval period to consider evidence of potential value; however, the peri-approval period is relatively short. By not treating value as an equally pressing need alongside clinical development, products may launch without the necessary information in place to demonstrate value to all stakeholders. This can negatively impact acceptability of, and access to, the product.

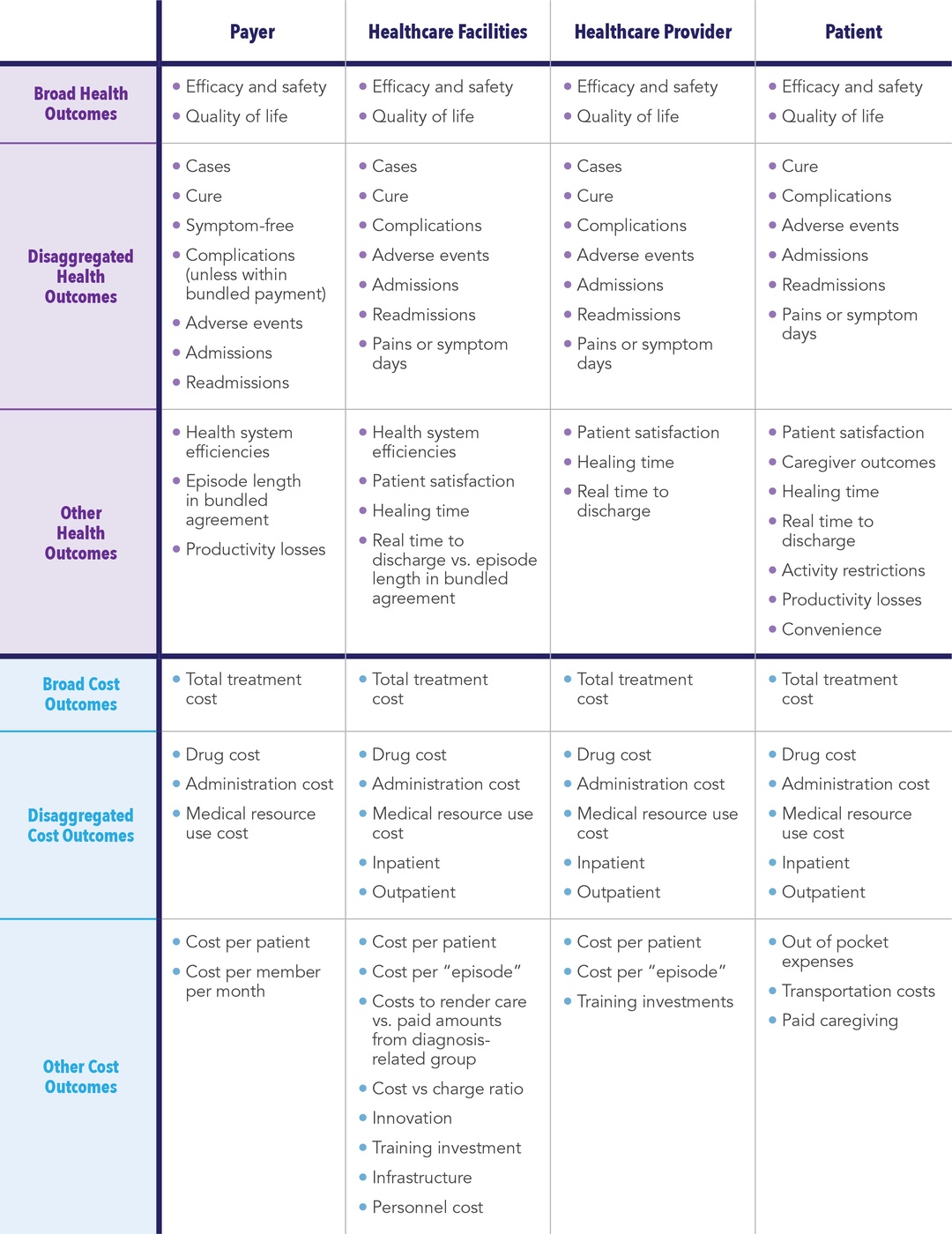

Several stakeholders sit at the “value table” (See Figure 1). Each stakeholder has specific needs that must be met before they will approve or facilitate access to a product. Sometimes these needs align and sometimes they differ substantially. For example, both healthcare payers (including for-profit commercial insurers as well as government entities) and healthcare facilities tend to focus on budget management and are therefore more receptive to value demonstrations focused on cost. This generalization is not always true, as some services are capitated. This means that while the payer will not need to worry about the use of a new product (assuming it does not impact an existing contract), the facility receiving the capitated payment will need to be concerned with the prospect of losing money.

Similarly, both physicians and patients tend to prioritize potential health benefits (versus risks) associated with a new therapy. However, physicians tend to consider costs (especially if under capitated payments) and the perceived burden of getting approval from payers to treat while minimizing risk (including malpractice lawsuits), while patients will typically focus on quantity and quality of life (i.e., a quick cure with the least chance of recurrence).

Why generate evidence that a therapy is “admission-sparing” if current standard of care results in profit to hospitals? For example, certain musculoskeletal procedures (e.g., knee or hip replacement; spinal fusion; treatment of dislocation/fracture of hip, femur, or other lower extremity; and amputation of lower extremity) make up 17% of operating room procedures, yet account for over 25% of hospital revenue.2 Therefore, hospitals have an incentive to perform more of these procedures, not less.

Assuming a “one size fits all” approach to generating a value proposition, as opposed to tailoring the message to each relevant stakeholder, therefore may result in regulatory approval without widespread use. This could, in turn, keep potentially life-changing therapies from the patients who need them the most.

Case Study 1 - Stem Cell Transplant: Is the Ounce of Prevention Preferable to the Pound of Cure?

Use of hematopoietic stem-cell transplantation (HSCT) in the United States (US) has increased steadily, with nearly 25,000 procedures performed in 2018.3,4 This has led to increased healthcare costs due to the rise in total hospital stays and post-HSCT complications.5,6 To help manage this issue, payers offer a “bundled” reimbursement to HSCT centers based on expected average costs. If the center exceeds this amount, they are not reimbursed and must absorb the financial loss.7

Several studies have indicated that unwanted, and potentially avoidable, complications post-HSCT (e.g., graft versus host disease and infections) are major cost drivers.5,8-10 Antifungal prophylaxis has been shown to reduce the incidence of invasive fungal infections, which are a leading cause of morbidity, infection-related mortality, and costs among HSCT recipients.11,12 Thus, there is value to both the patient and the center in preventing these complications. However, studies have shown that antifungal prophylaxis is underutilized in high-risk patients.13 It is possible that the risk versus value calculation for prophylaxis varies by institution and/or provider,14 since the cost variation by case mix can make the situation complex. Providers and institutions need to balance the cost of antifungal prophylaxis (which varies based on agent, dosage, route of administration, and duration of treatment)15 with the risk of the patient developing a fungal infection. This means the financial benefit of prophylaxis depends on whether it will offset the “downstream” costs of an infection.

Case Study 2 - Dialysis: Do Better Outcomes and Lower Costs Matter?

Barring kidney transplant, end-stage renal disease requires dialysis using either hemodialysis (HD), which is often administered in a dialysis center (in-center hemodialysis [ICHD]), or with peritoneal dialysis (PD), which is a portable system that allows the patient more freedom. Home-based HD is also a potential solution. Dialysis is expensive, albeit less costly in the short term than a kidney transplant, which is preferred when the organ is available and when the patient is a good transplant candidate.

Several studies have shown that PD is associated with lower risk of mortality (at least in the year following initiation of dialysis) and lower healthcare costs. Several countries, including the US, have established a “Home Dialysis-First” policy to incentivize patients to these preferred modalities.16,17 However, only about 10% of dialysis patients in the US received PD in 2017, despite the Centers for Medicare & Medicaid Services (CMS) enacting a prospective payment system that bundles most dialysis services.18 While there are many reasons for this, one may be a lack of compelling evidence geared toward healthcare providers. Physicians, who play a large role in a patient’s decision-making process, are likely incentivized to suggest ICHD. In the US, most physicians lack training in other dialysis modalities. During training, physicians are exposed mainly to ICHD; only 5% of a nephrologist fellow’s time (median value) is spent managing PD patients (it is 10% in Canada).19 There are also several financial incentives associated with HD, including owning a dialysis clinic and reimbursement mechanisms for anti-anemia therapy,20 as well as corresponding disincentives for PD. For example, in the US, Medicare and other payers generally do not cover PD-related educational sessions. These upfront costs are shifted to hospitals/institutions, which may pass them on to patients.21

Framework for Establishing Value from Different Perspectives

In both case studies, we believe if manufacturers had built a value framework early in the development process, they may have been able to quantify various stakeholder concerns and create relevant evidence of value necessary to improve treatment uptake.

Creating a rudimentary economic model early in the development process can help manufacturers test and assess the potential value of their product with multiple stakeholders. Such a model, assuming it can evolve as new information becomes available, allows manufacturers to evaluate and update potential value arguments alongside estimates of efficacy and safety throughout the pre- and peri-approval process. Each assessment can be shared with relevant stakeholders who can provide feedback that will help shape future evidence generation efforts, including:

- Potential design modifications to clinical studies

- Health economics and outcomes research (HEOR) efforts

- Internal (and potentially external) pricing discussions

These results can inform future updates and reruns of the model, thereby allowing the manufacturer to develop and evolve pharmacoeconomic arguments that are supported by clinical and HEOR studies and tailored to meet the potential objections and needs of different stakeholder groups.

Cost effectiveness analyses (CEA) are used for informing value to payers when cost effectiveness is part of the requirements for submissions for new treatments, particularly in countries with health technology assessment bodies. For that reason, manufacturers often build early models to evaluate cost effectiveness and expected incremental cost-effectiveness ratios from payer and/or societal perspectives and adapt that model to multiple geographies. However, a key outcome is the traditional cost per quality-adjusted life-year. Although these models are often equipped to estimate other clinical outcomes (e.g., cost per life-year gained or cost per event avoided), they are not well positioned to answer questions associated with how other stakeholders (e.g., healthcare facilities, providers, patients) perceive value.

Budget impact analysis (BIA) models are another helpful tool for multiple stakeholders, including payers and facilities, by forecasting expected costs associated with a new treatment. However, their role is limited as they typically only capture short-term affordability such as the financial impact the new treatment might have on formulary or institutional budget. These models typically ignore other definitions of value.

Cost consequences analysis (CCA) is another method of economic evaluation that has not been widely used. CCA is a form of economic evaluation that allows for the presentation of disaggregated costs and a wide range of outcomes, thereby allowing stakeholders to form their own opinion based on perceived value that matters to them.22,23 Unlike CEAs where costs and outcomes are aggregated to a single estimate, CCA outcomes are not restricted and can include other measures of value, such as:

- Estimates of infections avoided

- Number of unscheduled outpatient visits

- Number of hospital readmissions reduced

- Days without symptoms

- Patient satisfaction

Unlike BIAs, CCAs are not restricted to differences between “new scenario with intervention” and “old scenario without intervention,” and can include other measures such as profitability for institution (or physician) or the cost to a patient.

CCAs are particularly useful early in the development lifecycle when it may not yet be clear which costs and outcomes will be most relevant to various stakeholders. This type of analyses is easily approachable and understandable with CCA since each stakeholder can select the component(s) most relevant to their own perspective.24 With that noted, CCA should be viewed only as a complement to, and not a substitute for, CEA and budget impact assessment (BIA). In fact, early CCAs can evolve to incorporate BIA and/or CEA.

Given that funding for value propositions is often limited early in the development process, and that the asset-specific information required to conduct robust CEAs is often immature (or unavailable),25 CCA provides manufacturers with the ability to examine the potential value of a development asset side-by-side with corresponding assessments of efficacy and safety. This allows for comprehensive and repeatable assessments throughout the pre- and peri-approval process, including fully informing early discussions on potential asset pricing and “go/no go” decisions for subsequent clinical development (See Table 1).

Plan Early, Revisit Often

In our opinion, it is vital that some attention be paid during the early development phase to establishing value. As we have stressed throughout this discussion, perceptions of value differ by stakeholder. Similarly, a failure to identify relevant stakeholders and the evidence that will resonate with each may decrease the likelihood of a successful product launch.

In addition to the CCA, we recommend developing a plan that describes the evidence necessary for each relevant stakeholder and corresponding efforts required to generate that evidence. The plan should be developed early in the product’s lifecycle and have frequent checkpoints based on when new information (e.g., results of early evidence generation efforts, results from clinical studies, output from a CCA) become available. It should also have a predetermined plan to evaluate evidence generation efforts, how to support key differentiators between the development asset and currently marketed products, and, as applicable, information from competing manufacturers. As part of this plan, we recommend developing a cost-consequence model that can estimate outcomes specific to each stakeholder and then be updated when new information becomes available. While the plan and the model should be developed relatively early, both should be sufficiently robust to support evidence-generation efforts throughout the pre- and peri-approval process. Most crucial is the ability to evolve to incorporate new inputs and/or outputs as the relevant knowledge base grows through early evidence generation efforts and the clinical development program.

Conclusion

While necessary, regulatory approval does not guarantee a product will be added to formulary and/or reimbursed at the manufacturer’s requested price. Similarly, being added to formulary and reimbursed does not guarantee broad access and use. Once regulatory approval has been granted, the key to reimbursement and access is in the ability to demonstrate value that is both relevant to key stakeholders and enough to inform their decision making. It is important to proactively conceptualize how product availability will impact each relevant stakeholder group (e.g., payers, healthcare facilities, healthcare providers, and patients) and the evidence that each will need to change how they approach treating their condition. This is not an easy task. Stakeholders have different wants and needs, and what is a benefit to one may be perceived as a detriment to another. Accordingly, manufacturers should incorporate value demonstration early in the development lifecycle to fully inform internal discussions.

The need for robust value propositions that speak to different stakeholders will only become more important as new treatments, especially disruptive and transformative therapies, are developed and brought to market.

References

- DiMasi JA, Grabowski HG, Hansen RW. Innovation in the Pharmaceutical Industry: New Estimates of R&D costs. J Health Econ. 2016 May;47:20-33. doi: 10.1016/j.jhealeco.2016.01.012. Epub 2016 Feb 12.

- McDermott KW, Freeman WJ, Elixhauser A. Overview of Operating Room Procedures During Inpatient Stays in US Hospitals, 2014: Statistical Brief# 233. In: Healthcare Cost and Utilization Project (HCUP) Statistical Briefs [Internet]. Rockville (MD): Agency for Healthcare Research and Quality (US); 2006 Feb. 2017 Dec.

- Malfatto G, Lombardi F, Belloni A, Garimoldi M, Malliani A. [Effects of Passive Orthostatism on Ventricular Arrhythmia in Patients with Organic Heart Diseases]. Cardiologia. 1987;32(1):51-53.

- Center for International Blood and Marrow Transplant Research (CIBMTR). Summary Slides – HCT Trends and Survival Data. Published July 2020. Available at: https://www.cibmtr.org/ReferenceCenter/SlidesReports/SummarySlides/Pages/index.aspx. Accessed September 22, 2020.

- Khera N, Zeliadt SB, Lee SJ. Economics of Hematopoietic Cell Transplantation. Blood. 2012 Aug 23;120(8):1545-51. doi: 10.1182/blood-2012-05-426783. Epub 2012 Jun 13.

- Stranges E, Russo A, Friedman B. Procedures with the Most Rapidly Increasing Hospital Costs, 2004–2007: Statistical Brief #82. In: Healthcare Cost and Utilization Project (HCUP) Statistical Briefs [Internet]. Rockville (MD): Agency for Healthcare Research and Quality (US); 2006 Feb. 2009 Dec.

- Maziarz RT, Driscoll D. Hematopoietic Stem Cell Transplantation and Implications for Cell Therapy Reimbursement. Cell Stem Cell. 2011 Jun 3;8(6):609-12. doi: 10.1016/j. stem.2011.05.013.

- Lee SJ, Klar N, Weeks JC, Antin JH. Predicting Costs of Stem-Cell Transplantation. J Clin Oncol. 2000 Jan;18(1):64-71. doi: 10.1200/JCO.2000.18.1.64.

- Esperou H, Brunot A, Roudot-Thoraval F et al. Predicting the Costs of Allogeneic Sibling Stem-Cell Transplantation: Results from a Prospective, Multicenter, French study. Transplantation. 2004 Jun 27;77(12):1854-8. doi: 10.1097/01.tp.0000129409.84087.62.

- Svahn BM, Alvin O, Ringden O, Gardulf A, Remberger M. Costs of Allogeneic Hematopoietic Stem Cell Transplantation. Transplantation. 2006 Jul 27;82(2):147-53. doi: 10.1097/01.tp.0000226171.43943.d3.

- Kontoyiannis DP, Marr KA, Park BJ et al. Prospective Surveillance for Invasive Fungal Infections in Hematopoietic Stem Cell Transplant Recipients, 2001-2006: Overview of the Transplant-Associated Infection Surveillance Network (TRANSNET) Database. Clin Infect Dis. 2010 Apr 15;50(8):1091-100. doi: 10.1086/651263.

- Menzin J, Meyers JL, Friedman M et al. Mortality, Length of Hospitalization, and Costs Associated with Invasive Fungal Infections in High-Risk Patients. Am J Health Syst Pharm. 2009 Oct 1;66(19):1711-7. doi: 10.2146/ajhp080325.

- Fu R, Gundrum J, Sung AH. Health-Care Utilization and Outcomes of Patients at High Risk of Invasive Fungal Infection. Clinicoecon Outcomes Res. 2018 Jul 12;10:371-387. doi: 10.2147/CEOR.S162964. eCollection 2018.

- Sung AH, Rhodes T et al. Inconsistency in Defining Profound and Prolonged Neutropenia for Antifungal Prophylaxis Decisions. Paper presented at: ICAAC–ICC2015; San Diego, CA, USA.

- Cataldo MA, Petrosillo N. Economic Considerations of Antifungal Prophylaxis in Patients Undergoing Surgical Procedures. Ther Clin Risk Manag. 2011 Jan 13;7:13-20. doi: 10.2147/TCRM.S11895.

- Liu FX, Gao X, Inglese G, Chuengsaman P, Pecoits-Filho R, Yu A. A Global Overview of the Impact of Peritoneal Dialysis First or Favored Policies: An Opinion. Perit Dial Int. Jul-Aug 2015;35(4):406-20. doi: 10.3747/pdi.2013.00204. Epub 2014 Jul 31.

- Li PK-T, Rosenberg ME. Foreign Perspective on Achieving a Successful Peritoneal Dialysis-First Program. Kidney360. 2020 Jul;1(7):680-684. DOI: https://doi.org/10.34067/KID.0000712019.

- United States Renal Data System. 2019 USRDS Annual Data Report: Epidemiology of Kidney Disease in the United States. National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases. Available at: https://www.usrds.org/annual-data-report/current-adr/. Published 2019. Accessed 14 September 2020.

- Mehrotra R, Blake P, Berman N, Nolph KD. An Analysis of Dialysis Training in the United States and Canada. Am J Kidney Dis. 2002 Jul;40(1):152-60. doi: 10.1053/ajkd.2002.33924.

- Berger A, Edelsberg J, Inglese GW, Bhattacharyya SK, Oster G. Cost Comparison of Peritoneal Dialysis versus Hemodialysis in End-Stage Renal Disease. Am J Manag Care. 2009 Aug;15(8):509-18.

- Novak M, Bender F, Piraino B. Why is Peritoneal Dialysis Underutilized in the United States? Dial Transplant. 2008;37(3):90-90. doi: 10.1002/dat.20203.

- Drummond MF, Sculpher MJ, Claxton K, Stoddart GL, Torrance GW. Methods for the Economic Evaluation of Health Care Programmes. Oxford University Press; 2015. Available at: https://global.oup.com/academic/product/methods-for-the-economic-evaluation-of-health-care-programmes-9780199665884?cc=us&lang=en&. Accessed September 22, 2020.

- Brazier J, Ratcliffe J, Saloman J, Tsuchiya A. Measuring and Valuing Health Benefits for Economic Evaluation. Oxford University Press; 2017. Available at: https://global.oup.com/academic/product/measuring-and-valuing-health-benefits-for-economic-evaluation-9780198725923?cc=us&lang=en&#. Accessed September 22, 2020.

- Mauskopf JA, Paul JE, Grant DM, Stergachis A. The Role of Cost-Consequence Analysis in Healthcare Decision-Making. Pharmacoeconomics. 1998 Mar;13(3):277-88. doi: 10.2165/00019053-199813030-00002.

- Hunter R, Shearer J. Cost-Consequences Analysis – An Underused Method of Economic Evaluation. National Institute for Health Research. 2014.

For more information, please contact

[email protected], [email protected], [email protected], [email protected], or [email protected].